How much do hair stylists make? The salon compensation structures survey

From commission to salary, hourly, tips, and bonuses, we found out how salon and spa professionals get paid.

Content Marketing Manager

There’s a good chance that if you’re here, you’re somewhere in the process of launching your own salon or spa business. If so, congrats! You’re in the right place.

One of the hardest parts of starting up a beauty and wellness business is determining the best way to pay your staff. How do most hairstylists get paid? What is the most common salon commission structure? How much do estheticians make? The list of questions could go on forever.

We get it. We did plenty of digging into these questions ourselves only to discover that there is painfully little information out there on the topic.

Seriously, there’s almost no data. It’s insane. That’s why we decided to find out for ourselves.

In an effort to provide beauty and wellness professionals with valuable insights about current industry trends on compensation, we conducted our own comprehensive beauty and wellness compensation study.

We surveyed hundreds of owners, managers, and staff across the United States and Canada to determine the most common compensation models, how payments and tips are handled, which commission structures are the most popular, and much more.

Want to find out how real salon and spa owners are compensating their staff? Check out the results of our survey below to see what pay models they're actually using most (and how well those methods actually motivate people to perform)!

About the Salon and Spa Compensation Survey

Data points are organized into sections that cover key findings like the most common spa and salon compensation models, priorities of employers and staff, additional relevant trends and demographics of survey respondents.

Top Salon and Spa Payroll Models

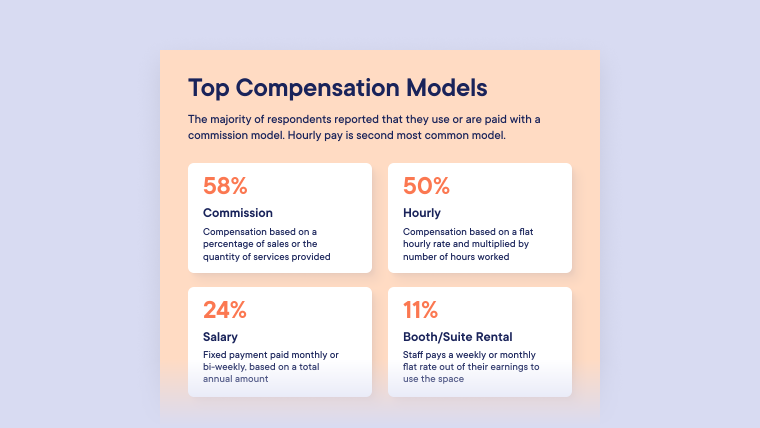

The four compensation models reported by respondents in this survey are:

Commission: Compensation based on a percentage of sales or the quantity of services provided

Hourly: Compensation based on a flat hourly rate and multiplied by number of hours worked

Salary: Fixed payment paid monthly or bi-weekly, based on a total annual amount

Booth Rental / Suite Rental: Staff pays a weekly or monthly flat rate out of their earnings to use the a space in an established business or property

The Most Common Salon and Spa Compensation Models

The majority of respondents reported that they use or are paid with a commission model. Hourly pay is second most common model.

Fifty-eight percent (58%) of respondents reported that they paid or received income via commission

Fifty percent (50%) of respondents reported that they paid or received income via a flat hourly rate

Twenty-four percent (24%) of respondents reported that they paid or received a salary via a fixed payment paid monthly or bi-weekly.

Eleven percent (11%) of respondents reported that they paid or received income via booth rental or suite rental

Payroll for Owners and Managers

Owners and managers were asked which compensation model or models they use in their businesses.

Seventy-five percent (75%) of owners and managers reported that they paid at least a portion of their staff via commission

Sixty-nine percent (69%) of owners and managers reported that they paid at least a portion of their staff via hourly rate

Twenty-five percent (25%) of owners and managers reported that they paid at least a portion of their staff via salary, paid monthly or bi-weekly

Seventeen percent (17%) of owners and managers reported that they receive payment from staff via booth rental or suite rental

Payroll for Salon and Spa Staff Members

Staff members were asked what the primary way is in which they are paid.

Forty-Two percent (42%) of respondents reported that they are paid via commission

Thirty percent (30%) of respondents reported that they are paid via hourly rate

Twenty-four percent (24%) of respondents reported that they are paid via salary, paid monthly or bi-weekly

Four percent (4%) of respondents reported that they pay booth rental or suite rental

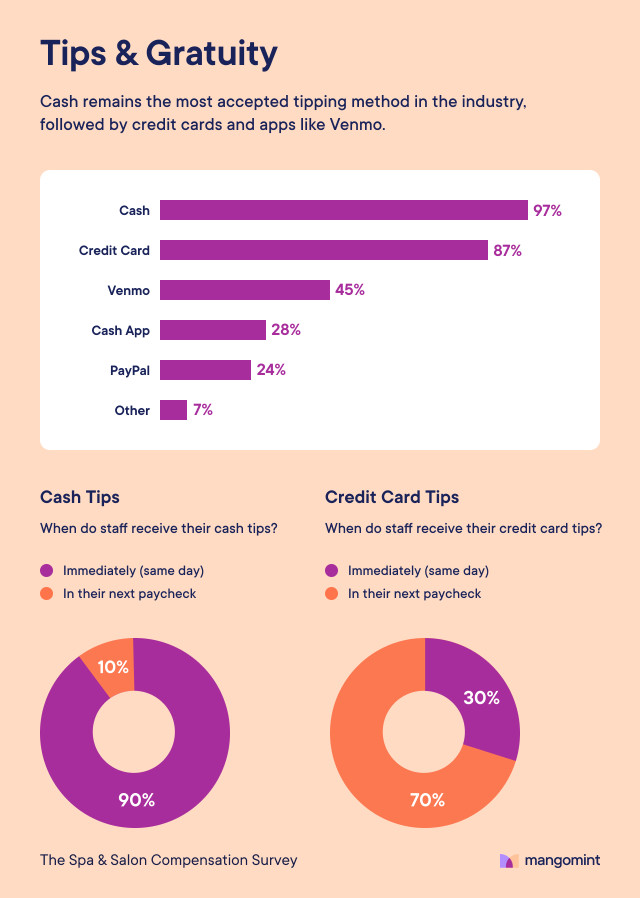

Tips and Gratuity in the Health and Beauty Industry

Cash remains the most accepted tipping method in the industry, followed by credit cards, and apps like Venmo.

Ninety-seven percent (97%) of respondents reported that they accept tips via cash

Eighty-seven percent (87%) of respondents reported that they accept tips via credit card

Forty-five percent (45%) of respondents reported that they accept tips via Venmo

Twenty-eight percent (28%) of respondents reported that they accept tips via Cash App

Twenty-four percent (24%) of respondents reported that they accept tips via Paypal

Seven (7%) of respondents reported that they accept tips via other transaction methods

Cash Tips for Salons and Spas

Survey participants were asked when staff receive their cash tips.

Ninety percent (90%) of respondents reported that staff receive cash tips immediately / same day

Ten percent (10%) of respondents reported that staff receive cash tips in their next paycheck

Credit Card Tips for Salons and Spas

Survey participants were asked when staff receive their credit card tips.

Thirty percent (30%) of respondents reported that staff receive credit card tips immediately / same day

Seventy percent (70%) of respondents reported that staff receive credit card tips in their next paycheck

Health and Beauty Industry Bonuses

Performance-based bonuses are mostly paid to service providers and sometimes to managers or other admin staff.

Fifty-four percent (54%) of owners and managers reported that they offer performance-based bonuses to their employees

Twenty-five percent (25%) of staff reported that they are offered performance-based bonuses by their employer

Spa and Salon Positions that are Paid Bonuses

Ninety-one percent (91%) of owners and managers reported that they pay bonuses to service providers

Fifty-four percent (54%) of owners and managers reported that they pay bonuses to managers

Fifty-two percent (52%) of owners and managers reported that they pay bonuses to receptionists and front desk staff

Twenty-three percent (23%) of owners and managers reported that they pay bonuses to assistants

Compensation Satisfaction in Salons and Spas

Owners, managers, and staff members were asked about their overall happiness with the form of compensation they offer and receive.

Seventy-five percent (75%) of owners and managers reported being happy or very happy with their compensation model

Eighty-five percent (85%) of staff members reported being happy or very happy with their compensation model

Zero percent (0%) of owners, managers, and staff members reported being very unhappy with their compensation model

Owners and Managers

Zero percent (0%) of owners and managers reported they are very unhappy about their compensation model

Five percent (5%) of owners and managers reported they are unhappy with their compensation model

Twenty percent (20%) of owners and managers reported they feel neutral about their compensation model

Forty-four percent (44%) of owners and managers reported they are happy with their compensation model

Thirty-one percent (31%) of owners and managers reported they are very happy with their compensation model

Staff Members

Zero percent (0%) of staff members reported they are very unhappy about their compensation model

Three percent (3%) of staff members reported they are unhappy about their compensation model

Twelve percent (12%) of staff members reported they feel neutral about their compensation model

Forty-two percent (42%) of staff members reported they are happy with their compensation model

Forty-three percent (43%) of staff members reported they are very happy with their compensation model

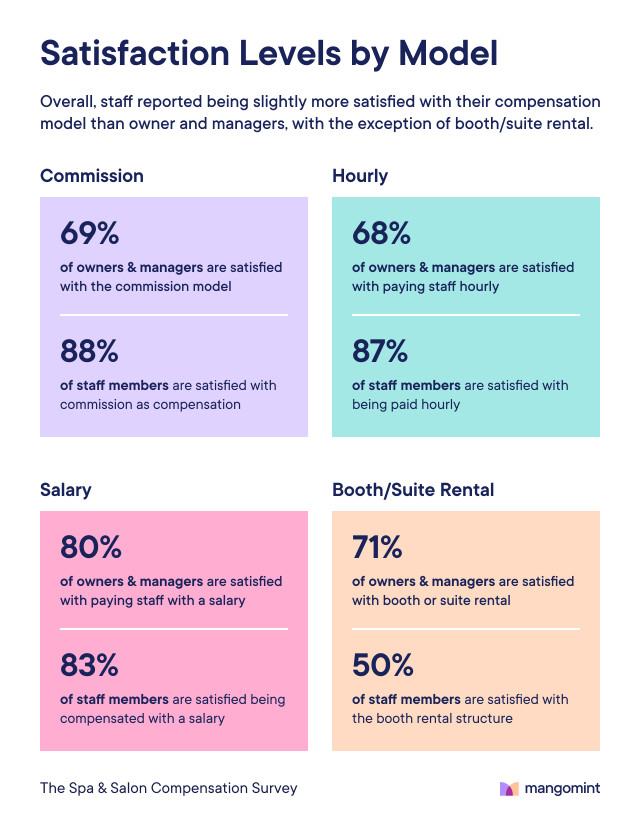

Satisfaction Levels by Model

Overall, staff reported being slightly more satisfied with their compensation model than owners and managers, with the exception of booth/suite rental.

Commission

Sixty-nine (69%) of owners and managers are satisfied with the commission model

Eighty-eight (88%) of staff members are satisfied with commission as compensation

Hourly

Sixty-eight (68%) of owners and managers are satisfied with paying staff hourly

Eighty-seven (87%) of staff members are satisfied with being paid hourly

Salary

Eighty (80%) of owners and managers are satisfied with paying staff a salary

Eighty-seven (87%) of staff members are satisfied with being compensated with a salary

Booth/Suite Rental

Seventy-one (71%) of owners and managers are satisfied with booth or suite rental

Fifty (50%) of staff members are satisfied with the booth rental structure

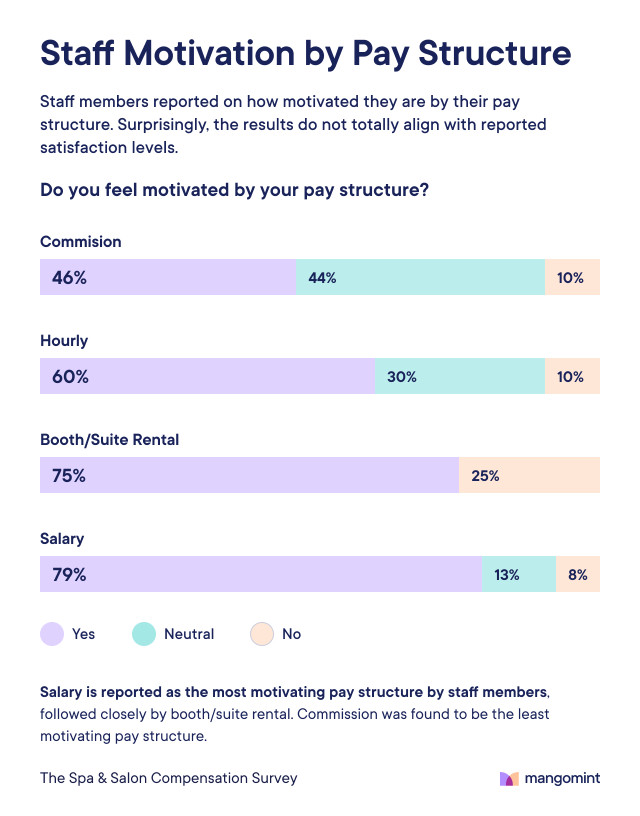

Staff Motivation by Pay Structure

Staff members were asked if they felt motivated by their pay structure. Surprisingly, the results do not totally align with reported satisfaction levels.

The salary pay structure made staff members feel the most motivated, followed closely by booth/suite rental.

Commission was revealed to be the least motivating structure according to respondents.

This finding is somewhat unexpected due to the nature of the commission model, which allows staff to increase their earnings through more work and sales.

Commission

Forty-six percent (46%) of staff members reported that they feel motivated by being paid with a commission model

Forty-four percent (44%) of staff members reported that they feel neutral about being paid with a commission model

Ten percent (10%) of staff members reported that they do not feel motivated by being paid with a commission model

Hourly

Sixty percent (60%) of staff members reported that they feel motivated by being paid with an hourly model

Thirty percent (30%) of staff members reported that they feel neutral about being paid with an hourly model

Ten percent (10%) of staff members reported that they do not feel motivated by being paid with an hourly model

Booth/Suite Rental

Seventy-five percent (75%) of staff members reported that they feel motivated by their booth/suite rental model

Twenty-five percent (25%) of staff members reported that they feel neutral about their booth/suite rental model

Salary

Seventy-nine percent (79%) of staff members reported that they feel motivated by being paid with a salary model

Thirteen (13%) of staff members reported that they feel neutral about being paid with a salary model

Eight (8%) of staff members reported that they do not feel motivated by being paid with a salary model

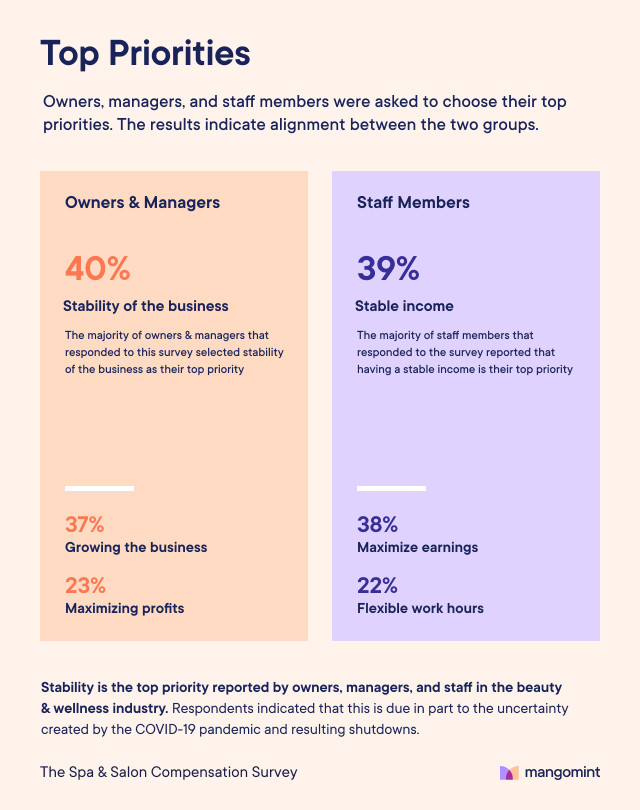

Top Priorities of Spa and Salon Professionals

Owners, managers, and staff members were asked to choose their top priorities. The results show alignment between the two groups.

Owners and Managers

Forty percent (40%) of owners and managers reported that the stability of the business is their top priority

Thirty-seven percent (37%) of owners and managers reported that growing the business is their top priority

Twenty-three percent (23%) of owners and managers reported that maximizing profits is their top priority

Staff Members

Stability is the top priority reported by both owners/managers and staff in the beauty and wellness industry. This result is understandable and somewhat expected after the uncertainty due to the COVID-19 pandemic and resulting shutdowns that kept many wellness and personal care businesses closed for extended periods.

Thirty-nine percent (39%) of staff members reported that stable income is their top priority

Thirty-eight percent (38%) of staff members reported that maximizing earnings is their top priority

Twenty-two percent (22%) of staff members reported that maintaining flexible work hours is their top priority

Demographics

Services Offered

The beauty and wellness industry is comprised of businesses that provide a variety of services, respondents reported offering the services below.

Fifty-eight percent (58%) of respondents reported they offer hair styling services

Forty-six percent (46%) of respondents reported they offer waxing or threading services

Forty-six percent (46%) of respondents reported they offer facials or skincare services

Thirty-four percent (34%) of respondents reported they offer massage services

Thirty-two percent (32%) of respondents reported they offer barbering services

Thirty-two percent (32%) of respondents reported they offer makeup services

Thirty-two percent (32%) of respondents reported they offer lash services

Thirty-one percent (31%) of respondents reported they offer nail services

Nine (9%) of respondents reported they offer medical services

Eight (8%) of respondents reported they offer tattoo services

Eight (8%) of respondents reported they offer airbrushing services

Five (5%) of respondents reported they offer acupuncture services

Two (2%) of respondents reported they offer other services

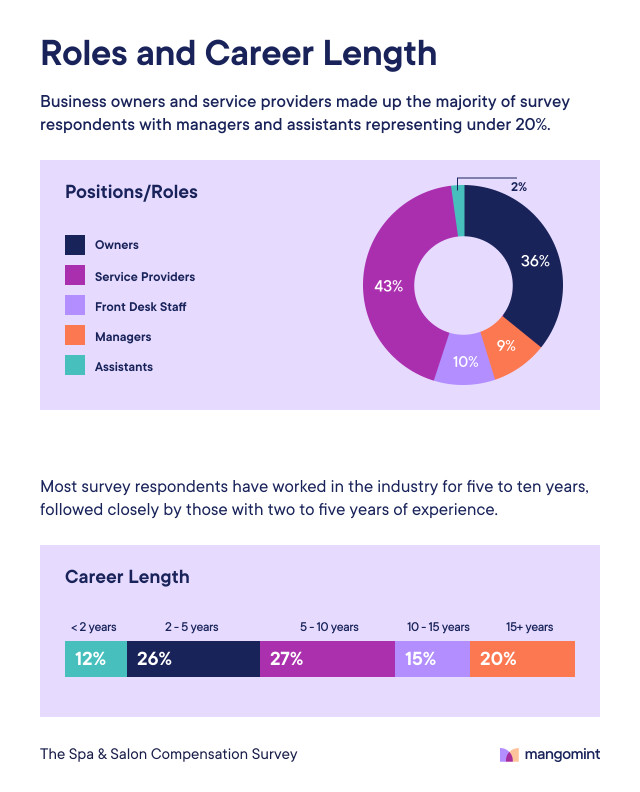

Roles

Business owners and service providers made up the majority of the survey respondents with managers and assistants representing under 20%.

Owners represented thirty-six percent (36%) of respondents

Service providers represented forty-three percent (43%) of respondents

Front desk staff represented ten percent (10%) of respondents

Managers represented nine percent (9%) of respondents

Assistants represented two percent (2%) of respondents

Career Length

Most survey respondents have worked in the industry for five to ten years, followed closely by those with two to five years of experience.

Twelve percent (12%) of respondents reported they have been working in their career for less than two years

Twenty-six percent (26%) of respondents reported they have been working in their career for two-to-five years

Twenty-seven percent (27%) of respondents reported they have been working in their career for five-to-ten years

Fifteen percent (15%) of respondents reported they have been working in their career for ten-to-fifteen years

Twenty percent (20%) of respondents reported they have been working in their career for more than fifteen years

Locations

Survey respondents are primarily located in the United States. The majority are from California, New York, Florida, Georgia, and Texas.

Ninety-two percent (92%) of respondents are located in the United States

Eight percent (8%) of respondents are located in Canada

Participant Percentage by U.S. State (Top 12)

Thirty-three percent (33%) of respondents are located in California

Eleven percent (11%) of respondents are located in New York

Seven percent (7%) of respondents are located in Florida

Five percent (5%) of respondents are located in Georgia

Five percent (5%) of respondents are located in Texas

Four percent (4%) of respondents are located in Massachusetts

Three percent (3%) of respondents are located in Montana

Three percent (3%) of respondents are located in Utah

Two percent (2%) of respondents are located in Illinois

Two percent (2%) of respondents are located in Oregon

Two percent (2%) of respondents are located in Maine

Two percent (2%) of respondents are located in Colorado

Race, Gender, and Age

Most survey respondents are white, Black, and Hispanic or Latino/Latinx. Seventy-five percent of respondents identify as female, while 46% are between ages 20-39.

Gender

Seventy-five percent (75%) of respondents reported that they identify as female

Twenty-four (24%) of respondents reported that they identify as male

One percent (1%) of respondents reported that they identify as non-binary

Age

One percent (1%) of respondents reported that they are under 20 years of age

Thirty-five percent (35%) of respondents reported that they are 20-29 years of age

Thirty-one percent (31%) of respondents reported that they are 30-39 years of age

Twenty percent (20%) of respondents reported that they are 40-49 years of age

Thirteen percent (13%) of respondents reported that they are 50 or more years of age

Race

Sixty-three percent (63%) of respondents reported that they are white/Caucasian

Fourteen percent (14%) of respondents reported that they are Black/African-American

Eight percent (8%) of respondents reported that they are Hispanic/Latino/Latinx

Three percent (3%) of respondents reported that they are Native American/Alaskan Native

Three percent (3%) of respondents reported that they are Asian

One percent (1%) of respondents reported that they are Native Hawaiian/Pacific Islander

Five percent (5%) of respondents reported that they would prefer not to state their ethnic or racial identity

Three percent (3%) of respondents did not select a response

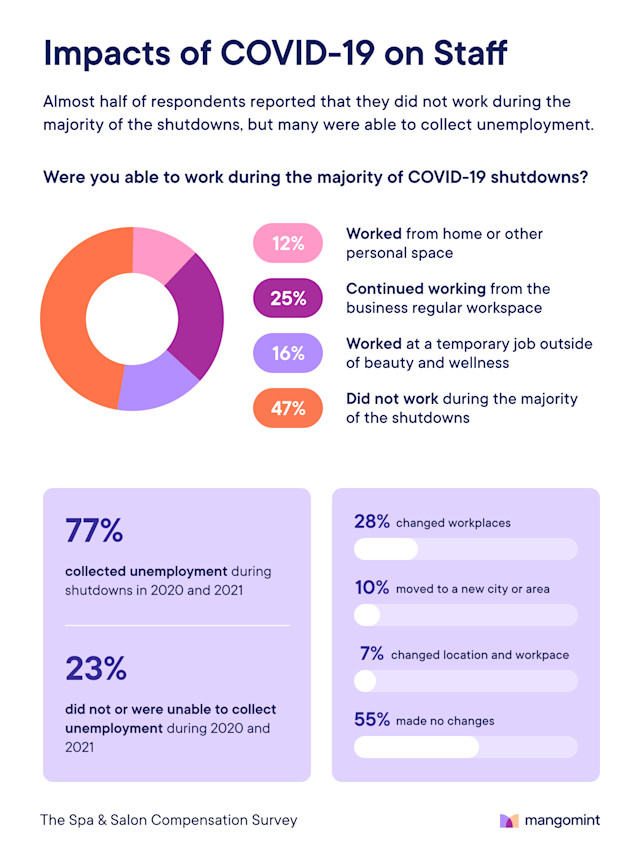

Impact of COVID-19

Impact of COVID-19 on Staff

Almost half of respondents reported that they did not work during the majority of the COVID-19 shutdowns during 2020 and 2021, but many were able to collect unemployment.

Ability to Work

Twelve percent (12%) of respondents worked from home or another personal space

Twenty-five percent (25%) of respondents continued working from the business / their regular workspace

Twenty-five percent (25%) of respondents continued working from the business / their regular workspace

Sixteen percent (16%) of respondents worked at a temporary job outside of beauty and wellness

Forty-seven percent (47%) of respondents did not work during the majority of the COVID-19 shutdowns

Ability to Collect Unemployment

Seventy-seven percent (77%) of respondents collected unemployment during the COVID-19 shutdowns in 2020 and 2021

Twenty-three percent (23%) of respondents were unable to collect unemployment during 2020 and 2021

Changes to Workplace and Location

Twenty-eight percent (28%) of respondents changed workplaces during 2020 and 2021

Ten percent (10%) of respondents moved to a new city or area during 2020 and 2021

Seven percent (7%) of respondents changed location and workplace during 2020 and 2021

Fifty-five percent (55%) of respondents made no changes during 2020 and 2021

Impact of COVID-19 on Employers

Participants were asked if the COVID-19 pandemic forced them to change the compensation model they use to pay their staff members

Thirty-nine percent (39%) of employers reported that they were forced to change their compensation model due to COVID-19

Sixty-one percent (61%) of employers reported that they were not forced to change their compensation model due to COVID-19

Try Mangomint for free

See Mangomint in action instantly with pre-populated sample data. No credit card required. Free for 21 days.

Try it now