FAQ: Payroll Processing

Link copied

How much does Payroll Processing cost?

Link copied

Which pay schedules are supported?

Link copied

Which compensation methods are supported?

Link copied

Can I pay my workers via direct deposit?

Link copied

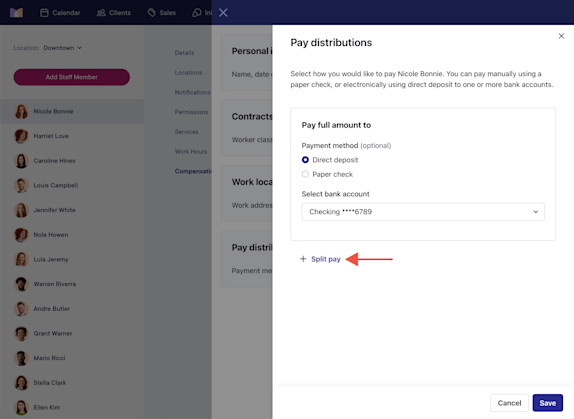

Can my workers distribute their direct deposit payments between multiple bank accounts?

Link copied

How do I set up benefit calculations and time off?

Link copied

How do I run an off-cycle payroll?

Can't find what you're looking for?

with us to talk to a real person and get your questions answered, or browse our on-demand videos.