Tips Settings for Payroll Processing

If a staff member is enrolled in Payroll Processing, you can choose not to pay out the staff member’s tips via Payroll Processing. This is helpful if you pay out your staff members' tips separately from payroll.

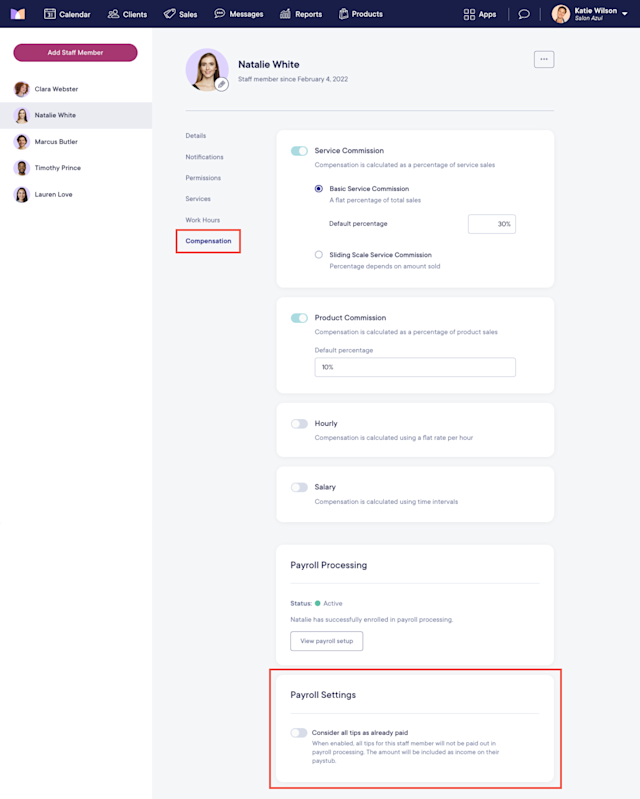

To do this, open the Staff Members app and select the staff member. Select the Compensation tab and go to Payroll Settings.

Link copiedTips settings for Payroll Processing (U.S.)Link copied

For U.S. customers, enable the Consider all tips as already paid toggle. When enabled, the staff member's tips will not be paid via Payroll Processing.

Link copiedTips settings for Payroll Processing (Canada)Link copied

For Canadian customers, use the Consider all tips as direct tips toggle to determine whether a staff member's tips will be paid via Payroll Processing.

When this toggle is enabled, the staff member's tips will be considered direct tips. Direct tips are paid directly to staff members and are not included in payroll payments or paystubs.

When this toggle is disabled, the staff member's tips will be considered controlled tips. Controlled tips are taxable income and will be included in payroll payments and paystubs.

Can't find what you're looking for?

with us to talk to a real person and get your questions answered, or browse our on-demand videos.