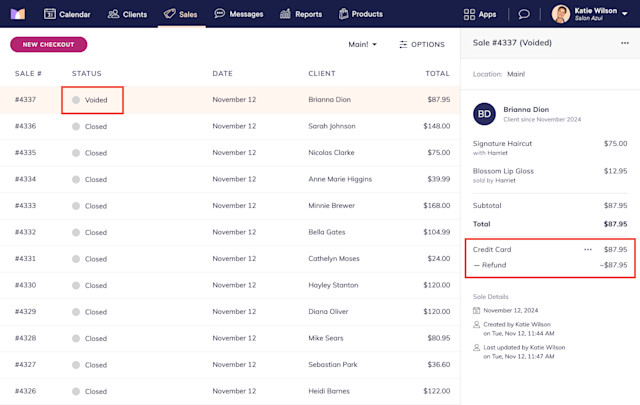

Voiding a Sale

Voiding a sale helps ensure your reports include accurate information.

When voiding a sale, you can refund or reverse any payments in the sale, including credit card payments.

Instead of voiding an entire sale, learn how you can refund or reverse individual payments in a sale.

Link copiedVoiding a saleLink copied

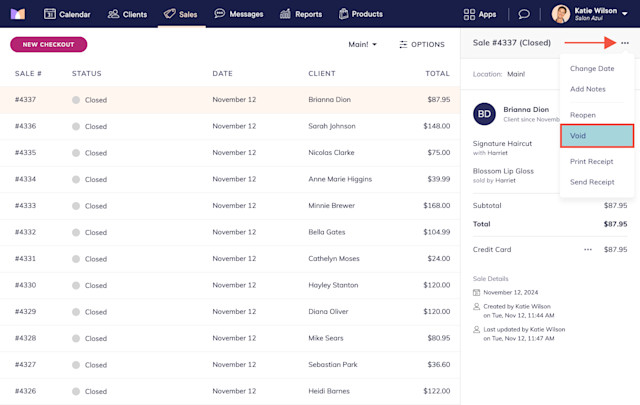

To void a sale, open the Sales app and select the sale to void.

Select Void from the "..." menu.

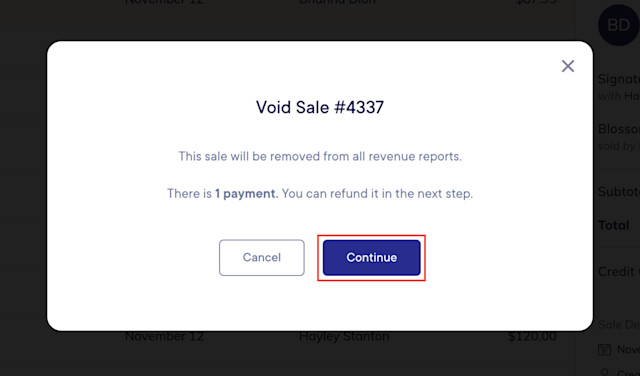

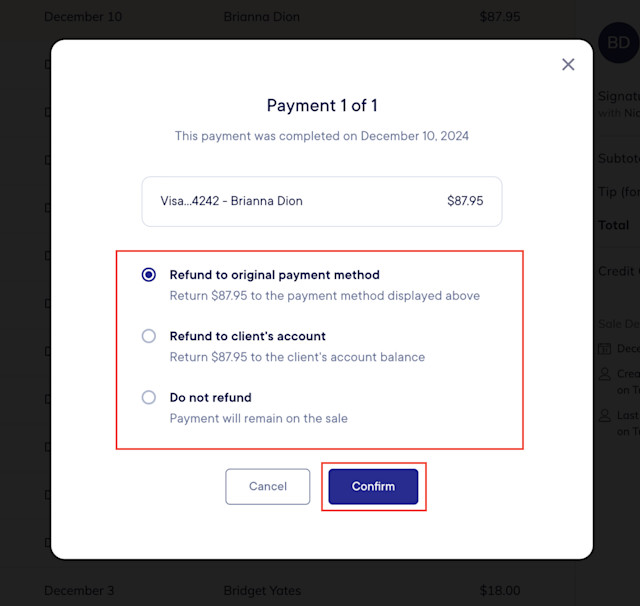

If the sale has any payments that have not been refunded or reversed, you can refund or reverse each payment.

Credit card payments can be refunded, while non-credit card payments can be reversed.

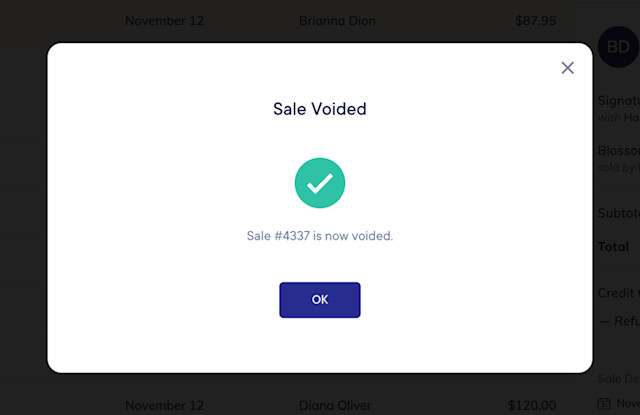

Once you’ve specified which payments to refund or reverse, the sale will be voided.

The original payments will appear in your reports on the original payment date. Refunds and reversals will appear in your reports on the date they were completed.

Reversing a gift card payment will automatically return the funds to the gift card.

Reversing a cash payment will immediately affect the expected balance of the cash drawer. For example, if you reverse an $80 cash payment, $80 will be immediately deducted from the cash drawer balance.

If you skipped refunding or reversing any payments in the sale, the sale will have a status of Voided (Remaining Payments). This allows you to filter the Sales app to find voided sales that still have payments that may need to be refunded.

Can't find what you're looking for?

with us to talk to a real person and get your questions answered, or browse our on-demand videos.